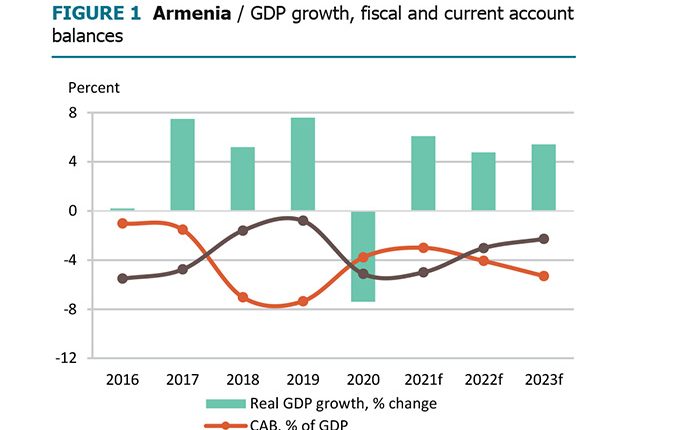

NEW YORK — Armenia’s economy is on course to grow by just over 6 percent this year after contracting sharply last year, according to the World Bank.

“The economic recovery in 2021 has been faster than anticipated, and the economy is likely to return to pre-COVID output levels by mid-2022,” the bank said in a report released this week.

“Following a faster-than-expected recovery in [the first half of the year,] the projected GDP growth rate for 2021 has been revised to 6.1 percent, up from 3.4 percent in April 2021,” it said, adding that the economic upswing will continue to be primarily driven by private consumption.

The International Monetary Fund has also signaled a significant improvement of its economic outlook for Armenia. A senior IMF official, Nathan Porter, forecast last month a 6.5 percent growth rate after holding virtual talks with Armenian officials.

The Armenian economy shrunk by 7.6 percent last year due to the coronavirus pandemic and the war with Azerbaijan.

The Armenian government had projected modest economic recovery until this spring. It now expects much faster growth not only in 2021 but also in the coming years.

The government’s five-year policy program approved by the parliament in August says GDP should increase by 7 percent annually. And a draft state budget unveiled by Prime Minister Nikol Pashinyan’s cabinet last week commits Armenian tax authorities to increasing state revenue by as much as 25 percent in 2022. This would not only finance a 15 percent rise in public spending but also cut the country’s budget deficit that widened significantly during last year’s recession.

The World Bank report says, however, that Armenian growth will likely slow down to 4.8 percent next year and only slightly accelerate in 2023. It also lists “downside risks” to this scenario: “limited progress in COVID-19 vaccinations, rising COVID-19 cases, geopolitical tensions, and a delayed recovery among major trading partners.”

The IMF’s Porter sounded a similar note of caution: “Downside risks remain elevated, including from geopolitical tensions, a slowdown in external demand, and heightened global financial market volatility.”