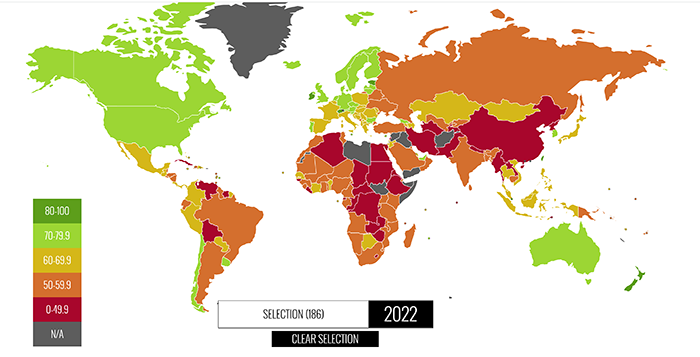

YEREVAN — Armenia’s economic freedom score in Heritage Foundation’s latest index is 65.3, making its economy the 58th freest in the 2022 Index. Armenia is ranked 34th among 45 countries in the Europe region, and its overall score is below the regional average but above the world average.

Compared to the neighboring countries, Armenia is second only to Georgia (26th) with “mostly free” economy, while being ahead of Azerbaijan (75th) with “moderately free”).

The two other neighbors of Armenia, Turkey is 107th with “mostly not free” and Iran is 170th with “repressed economy”, i.e. subject to pressure by the authorities.

Over the past five years, Armenia’s economic growth decelerated from 2017 through 2018, accelerated in 2019, turned negative in 2020, and rebounded in 2021.

A five-year trend of expanding economic freedom has been broken. Dragged down by steep drops in its labor freedom and business freedom scores, Armenia has recorded a 5.0-point overall loss of economic freedom since 2017 and has fallen from the “Mostly Free” category to the “moderately free” category. Scores for tax burden and government spending are relatively high, but rule of law and labor freedom exhibit weaknesses.

As of December 1, 2021, 7,610 deaths had been attributed to the pandemic in Armenia. The economy contracted by 7.6 percent in 2020.

Armenia gained its independence from the Soviet Union in 1991. In 2018, massive protests against corruption led to the election of a reform-minded government headed by Prime Minister Nikol Pashinyan, who was reelected in June 2021.

The economy relies on manufacturing, services, remittances, and agriculture. Russia is Armenia’s principal export market, and Armenia joined Russia’s Eurasian Economic Union in 2015. It also signed a Comprehensive and Enhanced Partnership Agreement with the European Union in 2017. The government relies heavily on loans from Russia and international financial institutions.

Despite a legacy of weakness in the rule of law and the judiciary, Armenian law protects secured interests in property, both personal and real, and provides a basic framework for secured lending. Title registration is supported effectively. Courts face systemic political influence, and judicial institutions are undermined by inefficiencies and institutional corruption. Despite government attempts to strengthen anticorruption efforts, corruption remains systemic.

The top individual income tax rate has been reduced to 22 percent, and the top corporate tax rate is 18 percent. The overall tax burden equals 22.5 percent of total domestic income. Government spending has amounted to 26.5 percent of total output (GDP) over the past three years, and budget deficits have averaged 3.2 percent of GDP. Public debt is equivalent to 62.8 percent of

The government does not interfere excessively with private businesses. The business registration process is straightforward, and there are few limitations on foreign ownership. Employers can adjust employment based on market conditions. Since 2014, the government has used more than €1 billion in blended loans and grants provided by the European Union to subsidize the energy, agriculture, and transport sectors.

Armenia has 11 preferential trade agreements in force.

The trade-weighted average tariff rate is 5.7 percent, and 10 nontariff measures are in effect. In general, government policies do not significantly impede foreign investment. The financial sector, dominated by banks, is evolving. The relatively small and fragmented banking sector is fairly well capitalized and open to foreign competition.